I realize that this is a bold statement. I realize this might offend some people who I have formed friendships or acquaintances with, however, having lived both lifestyles, I feel I can voice my opinion confidently (although it is based solely on experiences in Germany as shown below).

I truly mean no harm to anyone’s feelings. This is in no way some example of a lack of patriotism. And by no means is it meant to show ANY disrespect to the military,their families and the difficult roles they endure.

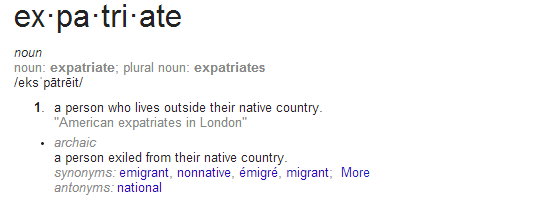

It’s a clarification on the use of a word.

It’s the truth.

Physical location is the only way in which this definition would loosely apply to you.

Let’s take a look…..

Military Families

- You do not have a foreign bank account and still receive your income in U.S. dollars. You bank at American banks, on base, that are set up to utilize that particular country’s banking system.

- You receive a USAREUR license, not a foreign driver’s license. While the test you take is similar, it is not as extensive as the one you’d take without your military umbrella. You are not required to attend any sort of driving school (aside from the short safety briefing) or have your license translated. The fee you pay is minimal in comparison. (last known, $10)

- When you shop off-base you refer to shopping in the “economy”.

- You have VAT forms making you exempt from paying local sales taxes.

- When you file your federal taxes, typically your stateside residence is what is used thereby excluding you from sometimes providing information related to foreign income and savings.

- Your medical insurance is still covered by the U.S. government and in most instances, you do not have to use foreign hospitals or treatment facilities.

- You have a special SOFA (Status of Forces Agreement) passport as well as your tourist passport. Your SOFA passport grants you residency in another country for the length of your tour.

- You are exempt from paying international postage fees when mailing anything to and from the U.S. Along those same lines, you can receive mail from any company that ships to APO addresses from the states.

- You are exempt from paying the local gas prices both on and off-base. (last known, $3.55/gallon)

- You are provided COLA (cost of living allowance) with your housing and utilities paid for whether you live on or off base.

- You are exempt from paying annual vehicle taxes that are required in Germany. Furthermore, you don’t have to pay for your car inspection.

Expats

- We have foreign bank accounts, no access to U.S. dollars and pay bills through the foreign banking system.

- Depending on what state you are from, in Germany you must either take the written and practical test, only the written test or you’re lucky and your stateside license transfers over completely. Based on those first two scenarios, you have to enroll in driving school. Furthermore, you must have your stateside license translated and pay all appropriate fees. We also must acquire our own study guides which are not always provided for free. (In my case, it’s a total of €250)

- The “economy” is my home, no differently than the U.S. is your home when you are there. Expats don’t use such terms as there is no other shopping option such as the commissary or BX.

- We pay the sales taxes with no exemptions. (19% here)

- We file taxes using our foreign address and in some cases are required to submit documentation from foreign accounts.

- We are covered through insurance provided in our country of residence. We only utilize healthcare options available in our country.

- We only have our tourist passports and must go through the visa/immigration process rendering us our residence permits.

- We only have access to our postal system, thus paying high international shipping rates and no access to stateside companies unless they ship internationally (again high fees) or they have an international store.

- Obviously, we must pay the local gas price which as of now is around $8.55/gallon in Germany.

- We don’t receive any kind of financial assistance or benefits for being an American living in another country.

- We pay, on average, €100 per year in taxes for our vehicle and the inspection costs €90 every two years.

Bottom Line

Expats live according to the laws and governing systems in the countries in which they have chosen to reside. Military families receive benefits for their service and maintain as close to an American lifestyle as possible while living in another country. Both choices are voluntary, but very different lifestyles.

I absolutely agree that military members and their families should receive these benefits.

I completely disagree that you should call yourselves expatriates.

While you may live here in the physical sense, you don’t live here. Take away access to your American life, fully divulge yourself into the lifestyle and culture of another country, follow their rules and systems and only then you’ll know what I’m talking about.

Yes, I once lived overseas as a dependent of a military member.

No, I never, not once, called myself an expat.

But I do now.

I have no ties to my “American” life aside from family and friends in the U.S. I fully embrace Germany as my home and do my best to live here just as any German would; no exemptions.

I live my life solely as an American expatriate in Germany.

I am an Expat.